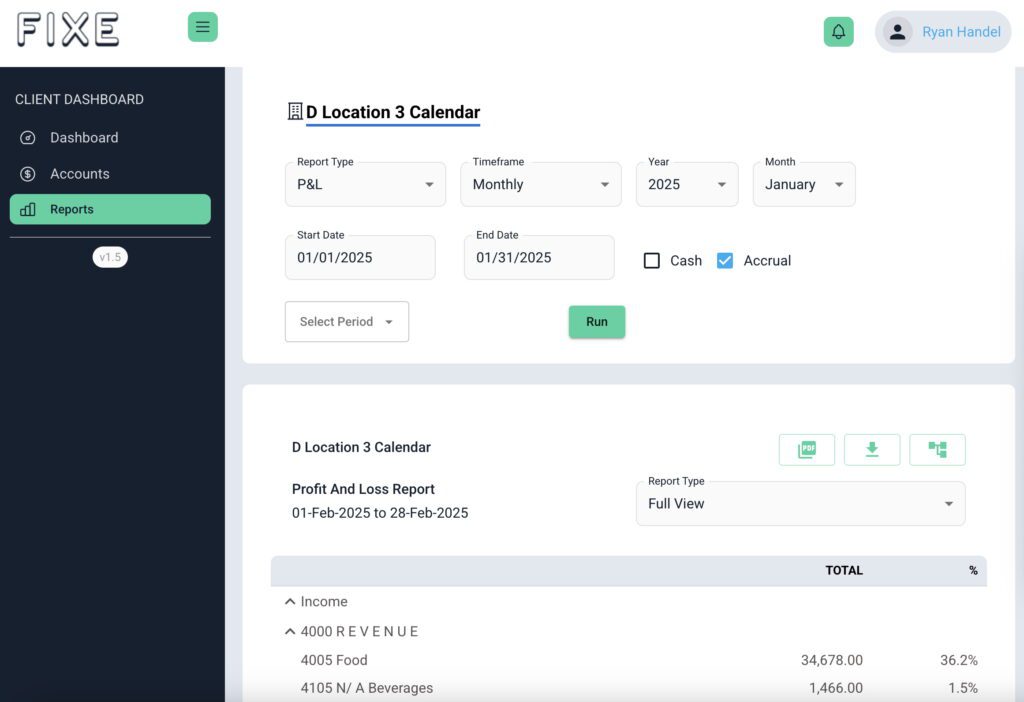

Restaurants have three main choices when keeping financial records. You can track expenses, vendor payments, payroll and sales in a monthly calendar. Companies can also follow financial calendars with 4-week, 4-week and 5-week blocks each accounting quarter or in 13 4-week periods. Each option has strengths and weaknesses to consider when deciding what’s best for you.

The purpose of doing period reporting – 4-4-5 and 13-period – is so that there’s an equal number of weekends and days of the week in each reporting period. If you do monthly reporting, some months, you’ll have four weekends and some months you’ll have five weekends. With period reporting, every single week starts on a Monday and ends on a Sunday. Unless the client chooses to have their weeks start on other days.

An independent operator who is starting a restaurant for the first time should probably start on a monthly system, and then potentially change to a period system after their first year of operations. Get your feet under you and get a better grasp on the business before moving to period reporting.

If you’re a restaurant starting up for the very first time, you’re still learning, you’re still figuring out what your monthly expenses are, and even though FIXE does a good job of helping you with this, there are still going to be unforeseen things pop up that you realize in year two. It’s tough to accrue and allocate expenses evenly across periods if you aren’t even sure what your routine expenses are on day one.

I wouldn’t say everyone should do the period system right from the get go if they’re opening their first restaurant. However, if you’re a restaurant chain and already have your systems a bit more dialed in, I have no problems starting on the period system as you open up other locations.

As you start comparing yourself to other locations in your business, period reporting becomes important in order to standardize and account for fluctuations. Migrate to period reporting when you want to have more consistent, comparable financials. Also, on the payroll side, it’s cleaner in terms of your payroll allocations for the periods.

MONTHLY STRENGTHS AND WEAKNESSES

Every month, you have 28 – 31 days. Say your rent is $10,00 per month, which is an expense that’s the same every single month. In a 4-4-5 schedule, you’re going to have some months where that $10,000 looks really expensive, if it takes four weeks of sales to pay for it. Then you’re going to have one month, where it looks really cheap, because you have one month out of the quarter, where you have an extra week of sales. Monthly expenses such as rent, utilities and insurance in a monthly reporting setup become more closely tied to the timeframes. And that makes it a little easier to analyze.

Monthly financials are harder to analyze from a sales standpoint. Sales fluctuate greatly on weekends, especially if you’re a fine dining restaurant. You want to be able to compare the same amount of weekends across the board. It’s much better to use period reporting to compare sales.

PERIOD REPORTING STRENGTHS AND WEAKNESSES

The dangers of going to a 13 period system is that monthly expenses are sometimes hard to spread out evenly across all 13 periods. Obviously, rent and insurance, where there’s contractual obligation, are easy to spread over 13 periods, but monthly expenses that fluctuate and aren’t predictable like Toast payroll fees, credit card processing fees and utilities become harder to allocate evenly over 13 periods versus just letting them hit the month they incur.

Utilities are fluctuating costs. For example, the Los Angeles Department of Water and Power (LADWP) charges me for electricity. And every month they charge me $2000 – $4,000. Well, how do you spread that over 13 periods? Someone would say, “Just put an estimate in for those 13 periods.” In the end, LADWP charges me X number of dollars for the whole year. And I have to allocate that over 13 periods and I’m not going to wait till the end of the year to do that.

In 13 four-week periods, every period is exactly four weeks. What happens there is those monthly expenses, where you get billed 12 times out of the year, you now have to adjust those to make them accrue for 13 weeks out of the year. If you’re paying $10,000 a month for rent, you now have to do some arithmetic and accruals in order to make it approximately $9,200 across 13 periods. That’s easy to do on basic expenses like rent and insurance. It’s harder to do for smaller expenses, such as software charges or subscriptions.

It’s impossible to accrue every single little expense. Most people don’t accrue things under $1,000 or under $500 to be spread across 13 periods. It requires a lot more effort and work to spread every monthly expense down to 13 periods. The danger is, accruals become inaccurate over time if the price of subscriptions and the price of these monthly expenses – outside of contractual agreements – end up changing. You also may stop subscribing to a subscription.

Vendor payments don’t make any difference, because you get invoices every single day. You also have labor costs every single day, so I could slice and dice any way, but there are some advantages for both 4-4-5 and 13-period financials.

Payrolls are typically every two weeks, bi weekly. It’s not weekly payrolls. On a period system, the payrolls are closer aligned to your periods than to the month. On a monthly calendar, your payroll is every two weeks. At the end of the month, you’re probably going to have days of labor where you didn’t incur payroll yet. Say the payroll doesn’t overlap for the last three days in the month. That payroll happens the following month. So we have to make an estimate for three days of labor. We do our best to account for this by using your POS system and estimating salaries. But if you’re on a period system, and your periods line up exactly with your payroll, then you never have to create an estimate.

MY RECOMMENDATION

13 periods allow for the most comparable set of financials because every period is exactly four weeks. It becomes trickier to allocate monthly expenses, which then makes it harder to compare. All of a sudden, you have a month with no utilities. Or you have a month with no payroll fees. What happened? So I prefer 4-4-5. It’s a hybrid of the 13-period and monthly system.