Running a restaurant is never easy, but there are ways to streamline your business. The staggering amount of financial data and statistics available could bury us, so it’s better to limit the scope to essential categories. Sometimes we get clients that like to overcomplicate things, which slows down the financial process. The truth is you want your financials to be as real time as possible, and as easily accessible as possible. By having too much information, the point of financials gets lost.

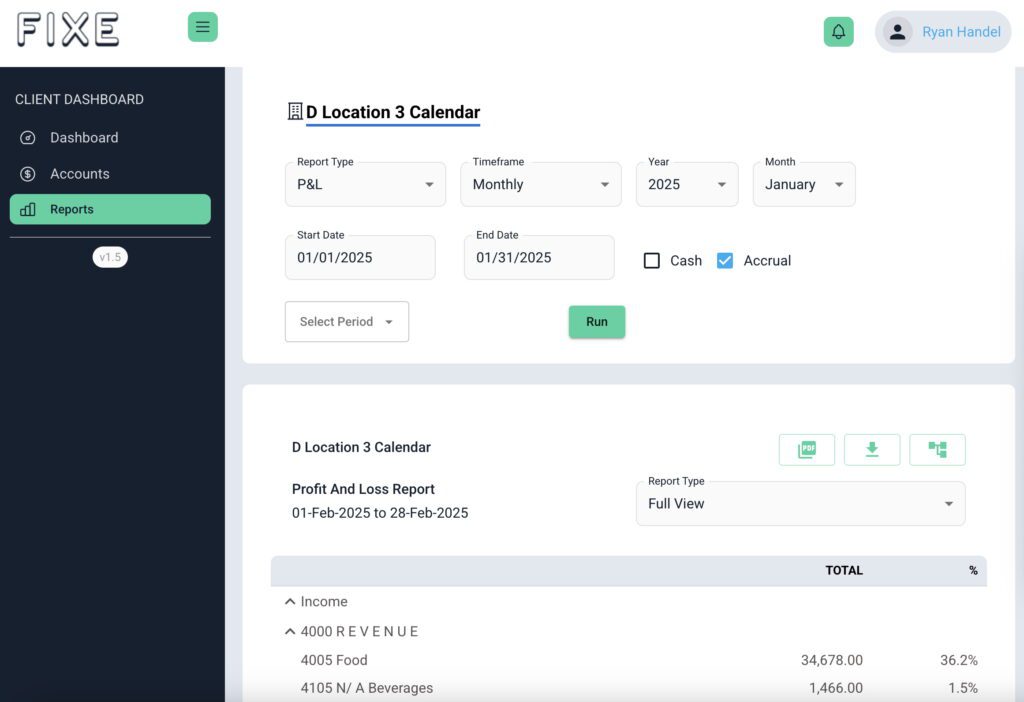

Financials are meant to show your Profit & Loss. Your balance sheet shows your business’s health and profitability. Statistics tell us more about performance, but don’t quantify whether you have a successful business.

Sometimes people think they need to see table turns, sales by day part broken down by hour, and things like that. They are important pieces of information, but should not live in your financials. Those are easily accessible with new POS systems, cloud based POS systems, and new third party softwares that a lot of restaurants are using. Or on FIXE. Eventually all of these other metrics will be in our portal altogether.

I came from Daily Grill. We would have these giant P&Ls that had year over year and month over month, table turns, guest counts, average check, all this stuff. Honestly, I would never read any of it. What are my food costs? What are my labor costs? Go forward from there.

Restaurants would rather get their financials 5 days earlier than have all that other aggregated information. That’s what we try to do, and that’s what we strive to do with FIXE.

FINANCIALS

You should obviously care about:

- Sales

- Cost Of Goods Sold (COGS)

- Labor Costs

These categories dictate your prime cost and prime profit.

You should also care about:

- Operating Expenses

- General Administrative Expenses

- Cash Flow

- Accounts Payable

Financials revolve around one area, your bank account. It’s how you’re performing based on dollars and cents coming in and out of your bank account. Anytime you are collecting money or paying money, whether you’re looking at your financials on a cash basis or accrual basis.

We understand a lot of restaurants want to see their P&Ls, but P&Ls don’t tell the entire story. P&Ls tell the story of how successful you were for a finite time period. Your balance sheet tells the story of how successful you are for the entirety of your business.

STATISTICS

Other important pieces of information, in our opinion, should be separate from the financials:

- Average Check

- Number of Covers

- Table Turns

- Sales By Day Part

- Product Mix

Statistics are other areas to measure how you’re performing within your own business or restaurant that don’t necessarily have to do with money coming in and out of your bank account.

Bookkeeping becomes a source of fact because it’s reconciled to your bank accounts and to your credit cards. That’s the basis for the information that we present in your financials. The basis of the information provided through statistics comes from other data sets, which are either in your POS systems, time clock punches or the other softwares that are out there.