When you learn about accounting in college, three main documents provide the complete picture of your business. These statements tie together to tell your entire financial story.

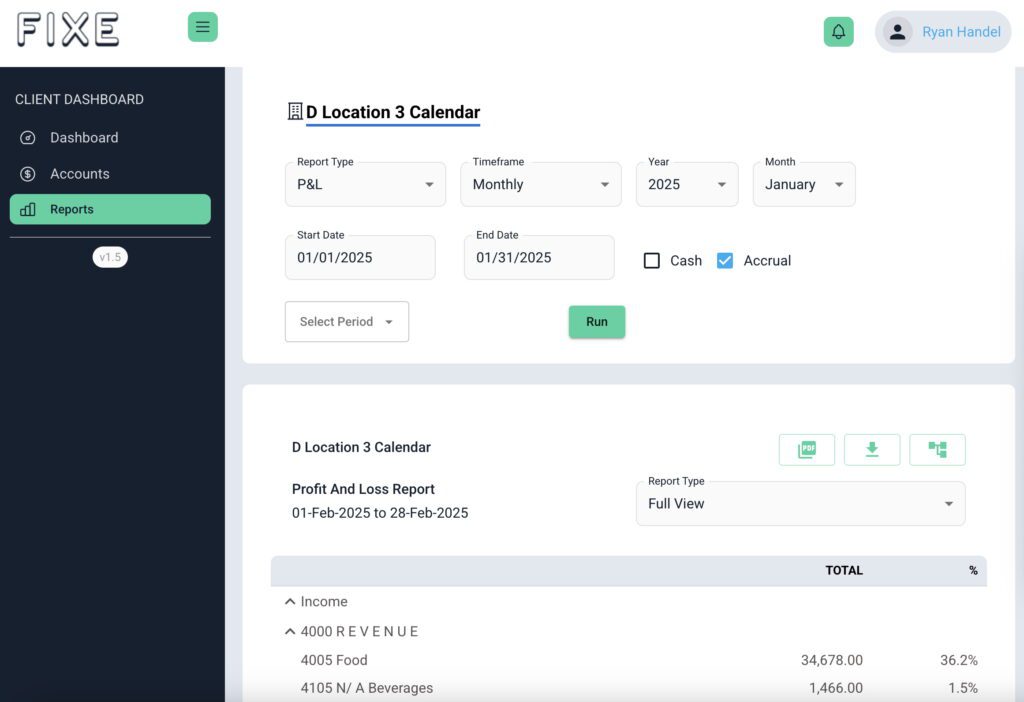

- The Profit & Loss report shows how you’re operating at any given point in time.

- The balance sheet shows your operating history, and the health of your business.

- Statement of cash flows shows how much cash you have, how liquidable you are.

Most operators focus strictly on the P&L. They want to see: “How did I do last month?” They don’t look at their balance sheet enough, because payments (or non-payments) can hide there.

I used to run a restaurant group called simplethings. When I took over my own set of books back in 2018, I got my balance sheet from the highly paid accounting firm that was handling it. I discovered a growing balance from Uber Eats and DoorDash orders that was artificially inflating my P&L because my accounting firm wasn’t reconciling those accounts receivable. If I had seen the balance sheet on a more routine basis, I would have identified the fact that something was not right. The firm I hired wasn’t correctly accounting for those receivables because they weren’t lining up the physical deposits that were coming into the simplethings bank account.

A lot of accounting firms won’t share the balance sheet on a routine basis. I never saw it at simplethings. You can ask for it. I did, and saw I made all this money, but also had a growing accounts receivable balance that was never addressed, So that wiped out our profitability. Ignoring your balance sheet can create confusion and mask major financial health concerns.

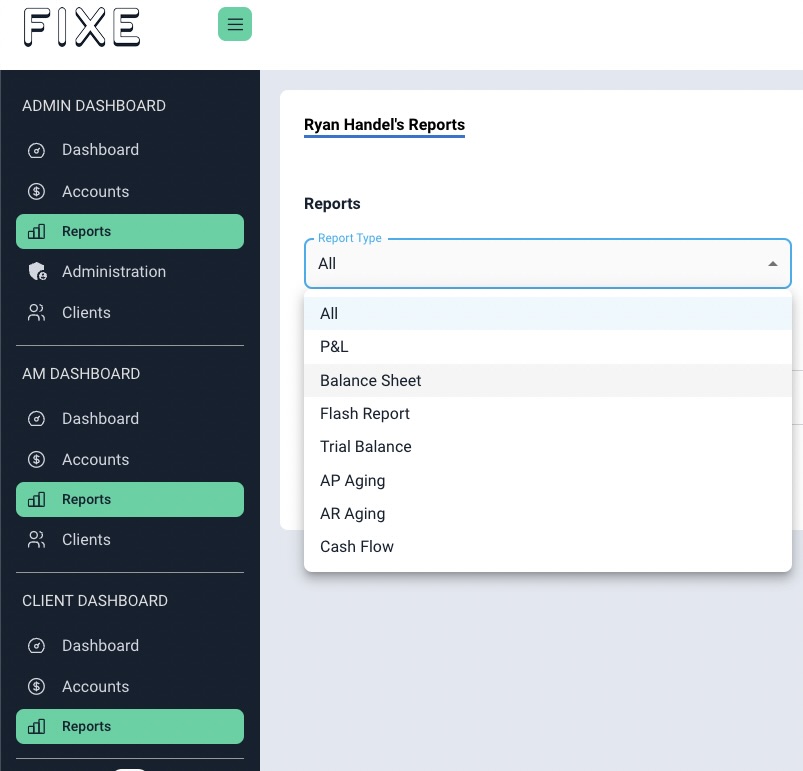

At FIXE, we look at accounts on a monthly basis. We try to spot errors and bring balance sheet discrepancies to your attention. We try to catch everything, but I encourage clients to review their balance sheets as well. Take a look. You may notice things, especially with 3rd party delivery apps, ezCater orders, and other receivables.

If your balance keeps growing, but you’re not seeing any deposits, that’s an issue, but correctible. Even if the FIXE account manager doesn’t point it out right away, you do have access to this information to review at any time. We are transparent and encourage feedback in case we need to make an update or adjustment.

Sometimes a restaurant operator will say, “We started this new program” – i.e. ezCater – and didn’t tell us about it. We must account for it. That’s another reason we encourage transparency.

P&L GETS AN INCOMPLETE WITHOUT YOUR BALANCE SHEET

The P&L provides a snapshot in time of how you’re performing, but it’s only as accurate as the balance sheet. If you don’t review accounts on your balance sheet, some accounts might be inaccurate on your P&L. Double check your balance sheet to make sure you’re in sync.

- If I’m using 3rd party apps – Uber Eats, DoorDash, GrubHub – do those accounts line up?

- Do the balances on those accounts represent about one week’s worth of deposits? If it’s more than that, something’s not right on the balance sheet for those specific accounts.

All restaurants should look for three key areas on their balance sheet:

- Accounts receivable

- Prepaid expenses or accruals. A lot of the time, a restaurant will pay for insurance for the entire year. They might pay $50,000. That expense must get allocated evenly, month over month or period over period. If that account on the balance sheet is not reducing accordingly, then the bookkeeper is not allocating that expense correctly.

- Employee tips. How employee tips work is that restaurants receive money on a daily basis from the POS system. Then restaurants must pay that money out on people’s paychecks every two weeks or every week, if you’re on a weekly payroll. I’ve seen two red flags related to employee tips that need to be addressed on anyone’s financials.

A) If you see that employee tip line on your balance sheet, and that number is larger than one payroll’s worth, then that category wasn’t handled properly.

B) Something negative on your balance sheet means we’ve paid too many tips, more than we’ve collected. That’s a different problem for your business.

STATEMENT OF CASH FLOWS ANSWERS MORE QUESTIONS

A lot of clients say, “I made $10,000 on my P&L, but I don’t see that in my bank account.” In order to tell the difference, restaurant operators have two options:

- Look how your balance sheet has changed over a period of time.

- Look at the statement of cash flows.

We tell clients, “You made money this month, you haven’t settled up with some of your vendors, you had an extra payroll this month, or you had an ancillary cash event.” Maybe you purchased equipment or did work outside of your P&L, which causes your cash flow to appear lower.

On the reverse side, restaurants say, “I have great cash flow. There’s all this money in my bank account.” Then they peel back the curtain and realize the only reason they have all this cash is because they’ve been slow to pay vendors. It could also be that payments haven’t cleared yet. You can answer those questions by understanding a statement of cash flows and operating cash flow.